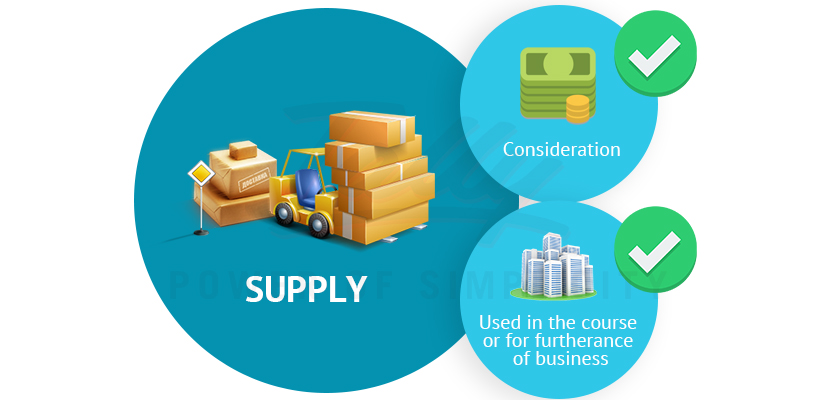

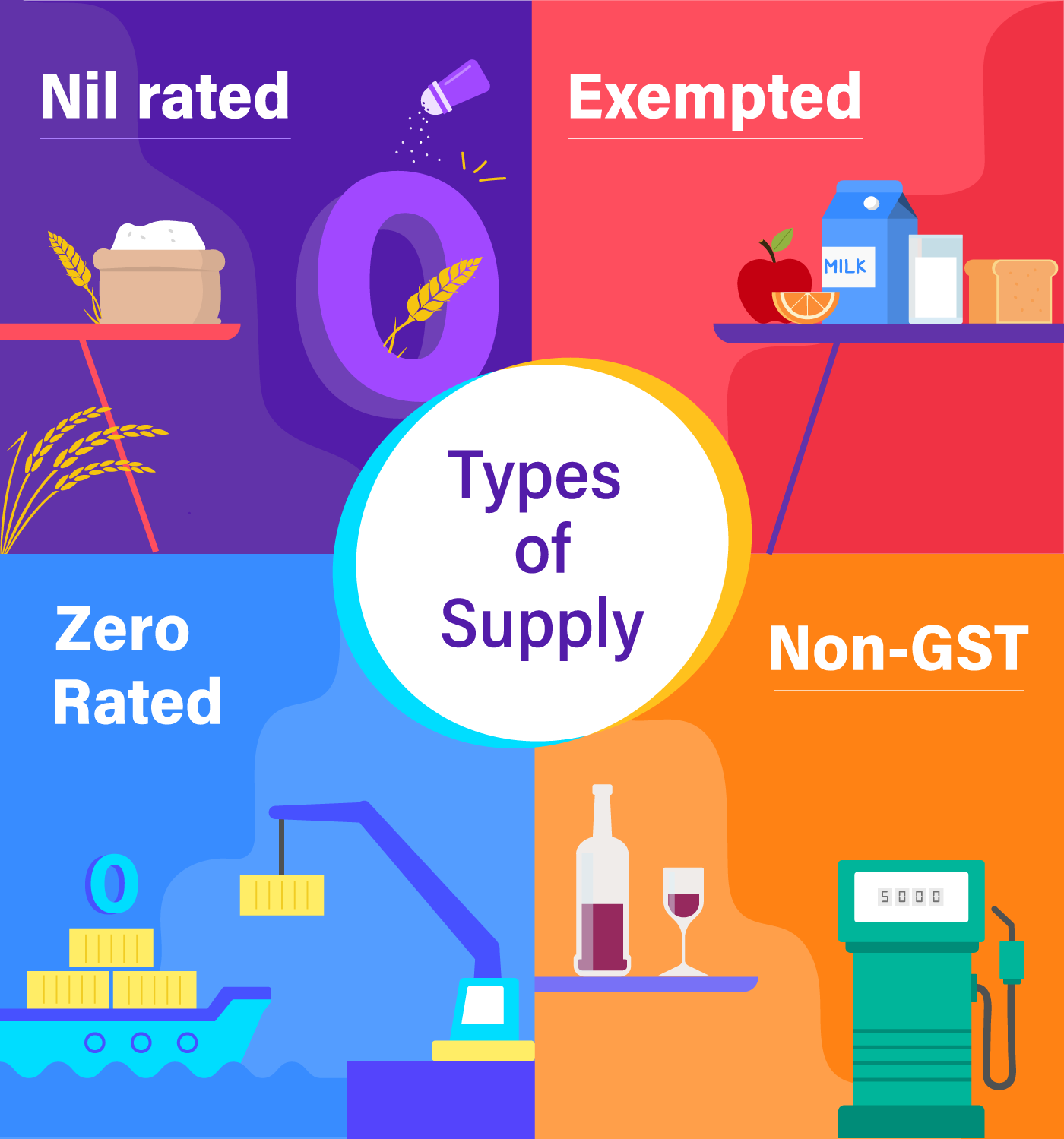

Meaning of Supply of goods and Supply of Services under GST – Advisory, Tax and Regulatory Compliance in India, Singapore and USA

Difference Between Stock and Supply (with Examples, Supply Function, Determinants of Supply and Comparison Chart) - Key Differences